Improved Forest Management

Image: Climeworks Direct Air Capture plant, Switzerland. Credit: © Climeworks / Julia Dunlop

Growth in the Voluntary Carbon Market

The voluntary carbon market (VCM) has seen unprecedented growth and demand for offset credits in recent years. The increase in demand stems from over 2,000 corporations pledging to reduce and offset their GHG emissions to achieve net zero targets. Additional demand for ACR credits is likely to emerge from the ICAO market in 2024, and from Article 6 of the Paris Agreement.

To achieve net zero and transition to a carbon neutral economy, science and government leaders concede that Natural Climate Solutions (NCS) will play an essential role and can contribute up to a third of the GHG mitigation needed by scaling up forest conservation and improved land-use practices.

Improved Forest Management

Improved Forest Management (IFM) under ACR is an activity that involves forest management practices that increase on-site stocking levels beyond a business-as-usual scenario. ACR IFM projects have a crediting period of 20 years (which can be renewed), and a minimum project term of 40 years.

Project Development Processs

There are several steps that must be taken to develop and implement a successful IFM project under ACR:

Feasibility Assessment

- Non-Federal U.S. forestland that can legally be harvested

- Clear land title or timber rights

- Forest certification (if lands are subject to commercial harvest)

- Native species composition

ACR Account

- Open an account with the American Carbon Registry, sign the ACR Terms of Use Agreement

Project Development and Implementation

- Conduct forest carbon inventory

- Prepare required project documentation (i.e., listing document, GHG Plan, quantification files)

- Model a baseline scenario

- Quantify the GHG emissions reductions and removals based on project activity

- Submit monitoring reports (at least every 5 years)

- Continually update inventory (at least every 10 years)

Project Validation/Verification

- Select an ACR approved third party validation and verification body

- Validate the project within three years of the start date

- Verify required project documentation and plot based inventories (5 year minimum)

ACR Review and Credit Issuance

- Submit all verification documentation to ACR for a final internal review

- Sign the ACR Reversal Risk Mitigation Agreement

- ACR issues serialized offset credits to the project proponent on the registry

Transaction

- Offset credits are available for transaction (i.e., transfer, retirement, cancelation)

IFM Baseline and Project Scenarios

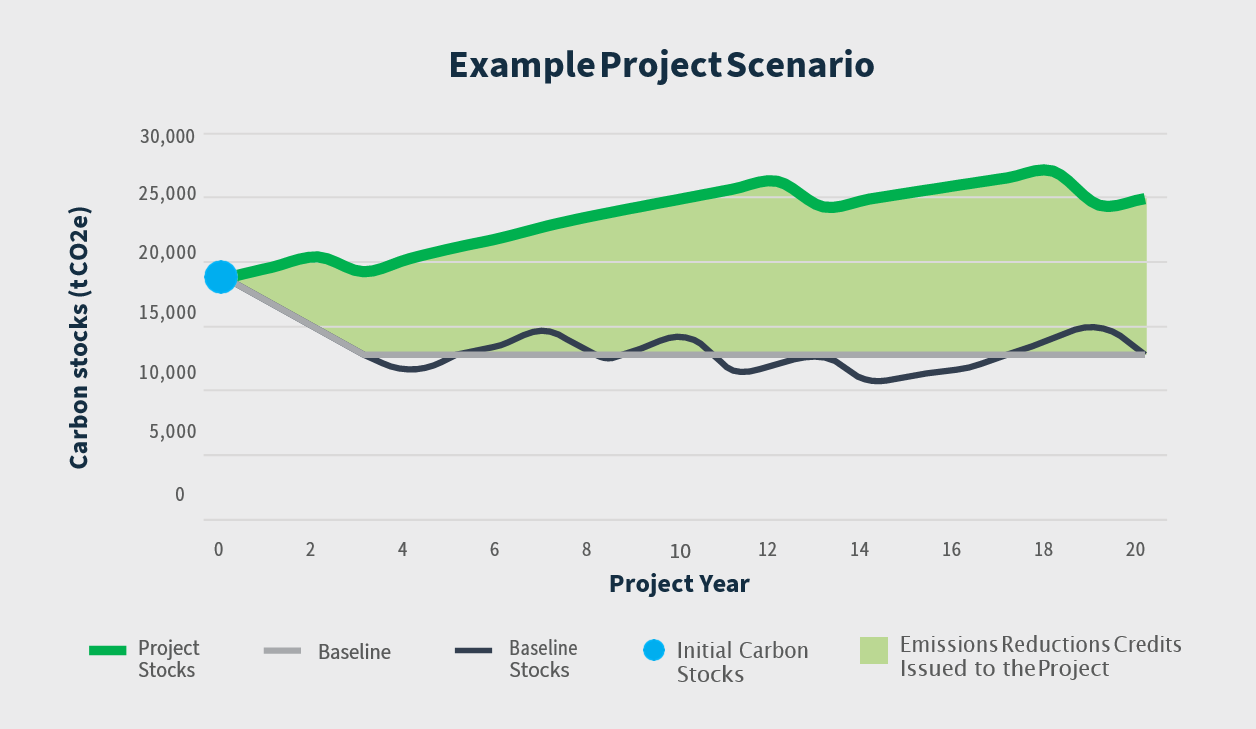

The IFM baseline is the legally permissible, feasible and plausible harvest scenario that would maximize timber revenue outputs. The resulting harvest levels are used to establish baseline stocking over the crediting period.

Increased stocking in the with-project scenario is measured and compared to the established baseline. The difference between baseline and project stocking indicates a projects GHG performance, a measure of the emissions reductions or removal enhancements quantified in metric tons of carbon dioxide equivalent (t CO2e).

The graph below provides a generic example of different trajectories for baseline and project carbon stocks. The example illustrates a project with light harvest on 100 acres over a 20-year crediting period. The delta between baseline and project stocks indicates the volume of offset credits issued to the project.

ACR IFM Methodology and Core Principles

Carbon offsets must adhere to core principles that ensure environmental integrity and scientific rigor. These principles are the foundation of the ACR standard and IFM methodology. These core principles include:

Real: The emission reductions or removals must be measured, monitored, reported, and verified ex-post to have already occurred.

Additionality: The project must generate ‘additional’ GHG removals, that exceed what would have occurred under a business-as-usual (baseline) forest management scenario.

IFM projects demonstrate additionality by applying the ACR three-pronged test:

- Project activities must exceed current effective and enforced laws and regulations, and activities must not be required by any law or regulation.

- Project activities must exceed common practice when compared to similar landowners in the geographic region.

- Project activities must face a financial or implementation barrier.

Permanent: Projects must commit to long term monitoring, reporting, and verification of carbon stocks and must contribute to a reversal risk buffer pool at each issuance to compensate for unintentional reversals. Requirements for reversal mitigation are set out in the legally-binding ACR Reversal Mitigation Agreement and include project compensation for intentional and unintentional reversals.

Leakage: All lands under the projects ownership and/or management must be certified by a sustainable forestry certification system to safeguard against shifting harvests to other lands owned by the project proponent but not enrolled in the carbon market. A conservative crediting deduction is applied to account for the possibility that reduced harvest activities increase market demand and shift harvests to other landowners.

Verification: All projects must be validated and verified by a qualified, accredited, and independent third party to assess the project against ACR requirements and that they have correctly quantified net GHG reductions or removals.

Transparent: All relevant documents and credit issuances are publicly available. ACR requirements and processes are clearly outlined in the ACR Standard and approved methodologies.

Contact ACR

For more information or questions on how to enroll your forestlands in an IFM carbon project, please contact the ACR forestry team at ACRForestry@winrock.org.